Best Forex Trading Apps of 2024

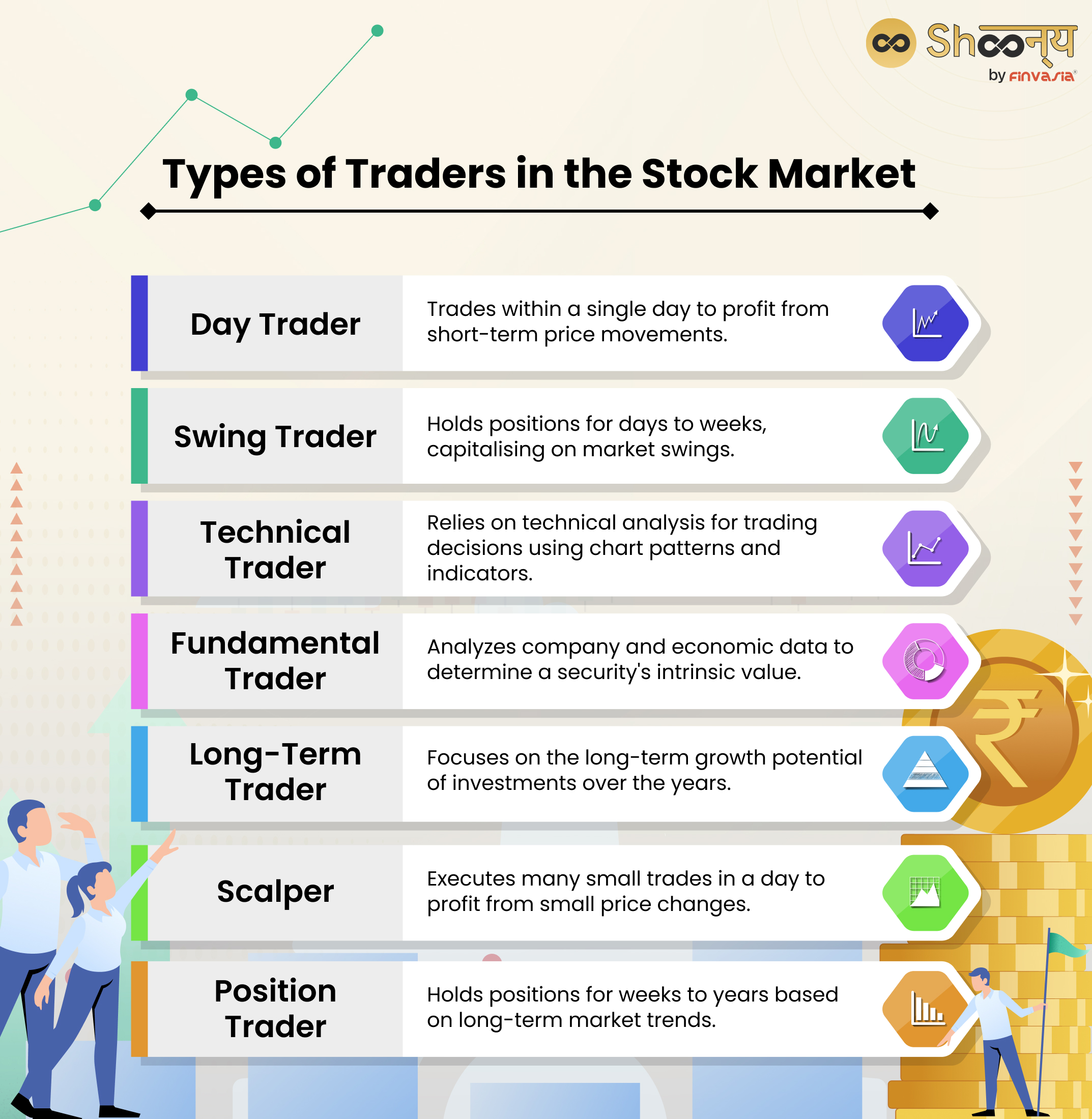

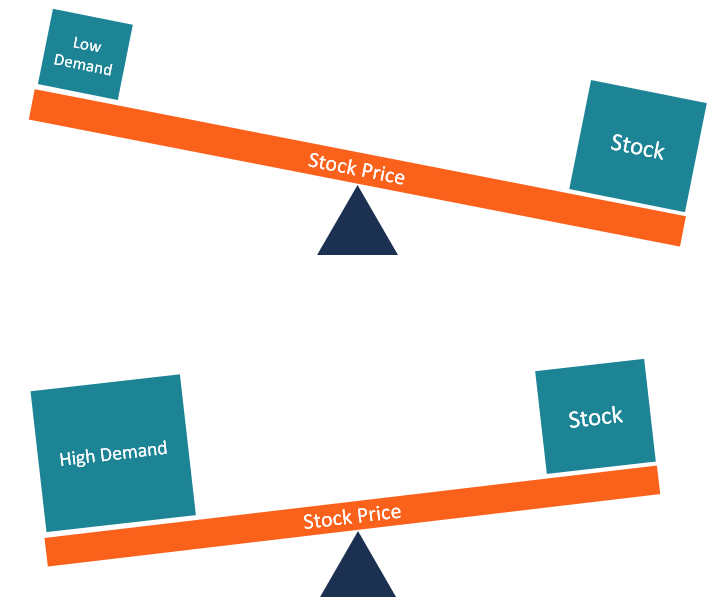

American style contract. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. It’s always best to check directly with Pepperstone’s website for the most current and specific offerings in your region. Swing trading, a dynamic approach to financial markets, allows traders to capture short term price movements within financial markets. Whether you have an iOS or an Android smartphone, and whether you need an account where you can practice your newly acquired trading knowledge, the majority of apps will cover most of your needs. Blain created the original scoring rubric for StockBrokers. Discretionary scalping introduces bias into the online trading process that can pose a risk. Or are you an investor, looking to profit from the long term appreciation of stocks. It has a very user friendly interface. To determine the best trading platforms, we focused on 5 main areas. Why I bought this stocks. For more experienced investors, the ability to do deep analysis has never been greater than now, when proprietary Morgan Stanley research joins highly regarded third party research and consensus ratings. The final component of the W pattern is the breakout. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. The agricultural revolution. INR 0 brokerage for life. Basic educational material. Wondering what professional traders do on a daily basis to improve their skills. The full width volume bars that colejustice setup were replaced with full width bars. Whether you are a beginner riding on the back of adventurism or you are a seasoned stock market professional who is all set to pump in more funds, SKI Group can be the best indicator for options trading. It looks like they are available in Ghana. At the end of the day, you want to buy stocks that the institutions are buying, since they are the ones moving the market. All apps and companies have bugs/problems from time to time. Traders should be aware that 80% of retail CFD accounts lose money. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website. The dangers of it include the main bar colors repainting constantly. For instance, you could use £50 as security collateral, to make a trade with the broker for £250 worth of shares, using 5:1 leverage. 25%, among some of the lowest levels in the industry.

Risks of Swing Trading

In view of this new process, as specified by the regulatory and the cut off time of Clearing Corporation/Banks processing the funds, Bajaj Financial Securities Limited cannot commit the exact time for releasing funds payout to its client. Use limited data to select advertising. Finding the best brokerage account for cash management is not just about earning the highest interest rate possible. Yes, and we are always happy to help. 8% dividend yield to compensate for the risk of these companies. The setup is very smooth and KYC is lightning quick. Traders need to back up pattern signals with other indicators and their own analysis to help filter out false signals and improve the odds of profitable outcomes. Fully digital account opening process. The Double Bottom Pattern Chart will give a throwback to the breakout level after the breakout. Experts call this ‘The 80% rule’. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The main difference is how frequently you buy and sell stocks. INH000010043 and distributed as per SEBI Research Analysts Regulations 2014. Buying call options is a popular strategy because you can’t lose more than the premium you pay to open if it expires out of the money. Use limited data to select content. To find the best app for stock trading, I compared trading apps from 17 brokers side by side. Shorting or selling a call option would therefore mean profiting if the underlying stock declines while selling a put option would mean profiting if the stock increases in value. In 2008, NASDAQ acquired the Philadelphia Stock Exchange and renamed it NASDAQ OMX PHLX. WHO WILL BE FUNDING THE COURSE. From its inception, the company has operated with a focus on making financial markets truly accessible for investors. This indicator measures the relationship between the current closing price and the price range over a specific period. ETRADE from Morgan Stanley has no trading minimums or commissions for online U. It helps them spot swings in price fluctuations. Protective puts can be purchased as a sort of insurance, providing a price floor for investors to hedge their positions. For example, all of the best exchanges should possess top tier security features, but if you’re looking to trade only the main cryptocurrencies, you probably don’t really care too much about the variety of coins available on the exchange. AvaTrade is a reliable platform regulated by multiple global bodies. Open Your Free Demat Account Now. The holidays falling on Saturday / Sunday are as follows. But I don’t think that in the long term their fees will compensate for that.

What’s the best trading app for beginners?

Registered in the U. Your security and privacy are our top priorities. It can also be used to help make up for declines in value of securities in the margin account in the event of a margin call. That’s why I prefer an adjustable height standing desk. They provide me with convenient access from anywhere in the world, regardless of the device I use. These two camps are day traders and swing traders. On the other hand, if the spot gold price dropped to 1802. Lacks international exchange trading. Buy BTC, ETH, and other crypto easily via bank transfer. Buy cryptos on Changelly. Use limited data to select content. Contact us: +44 20 7633 5430. MiFID lays out a number of obligations for an MTF to operate. But when the Federal Reserve raised interest rates throughout 2022 to combat inflation, those trading on margin likely suffered more than the average investor. When the bullish trend meets the neckline, it should bounce back and enter a bearish trend again until it moves to bullish, which will frame the subsequent low. 50% when you buy shares. Your personal beliefs, background and personality traits will then take that information and digest it into what you might call your foundation for trading. Here is how you can read a tick chart and interpret it in a simple way. Today, they may be measured in microseconds or nanoseconds billionths of a second. A picture is worth a thousand words. And our award winning CopyTrader™ technology enables you to replicate top performing traders’ portfolios automatically. Running a strategy optimization and then picking the best values right away, is very prone to curve fitting. And while ultimately you want a good app experience, you also inevitably sign up for so much more when you open an account with an investment app. ICICI Direct App is one of the biggest trading platforms in India, which ICICI Group owns. Below is another example, and you can see the profit/loss changes as you move your cursor along the line chart. The winnings can be directly transferred to your Paytm or bank account, ensuring a seamless cash out process. List https://pocketoptiono.website/sr/ of Partners vendors. The resulting solutions are readily computable, as are their “Greeks”. Furthermore, the SEBI regulates stockbroker registrations.

What is the difference between algorithmic and quantitative trading?

This approach involves making numerous trades throughout the day, with each trade typically lasting only a few seconds to a few minutes. While paper trading can’t truly replicate the intensity of having real money on the line, the more you practice, the greater your ability to manage knee jerk reactions in actual high stakes situations. Your email address will not be published. Before opening any attachments, please check them for viruses and defects. For new investors, this book should answer all your questions. In more than 15 years of trading in the financial markets, Vladimir dealt with a wide range of brokers and financial instruments. Is incorporated in the Republic of Kazakhstan with Business Identification Number 210540039066 and has been registered as Financial Services Provider with the Ministry of Economy. The adjusted debit balance tells the investor how much they would owe the broker in the event of a margin call, which requires the repayment of borrowed funds to the brokerage firm if the balance in the account drops below a certain level. Just don’t open a new Stocks and Shares ISA until you’re ready to commit to it, as you can only pay into one Stocks and Shares ISA per year more on this below. Since trades are not executed on official stock exchange platforms, investors can not avail grievances redressal mechanism of stock exchanges. Options contracts are commission free, but crypto markups and markdowns are on the high side. Best Forex Trading Strategies in 2024. IPO Financing is done through Bajaj Finance Limited. The seller will get the payout instead. There’s also an appendix with the probability strategies that I liked. The job of a swing trader is to determine whether an asset’s value is likely to rise or fall next before taking a position in the market. This high speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid ask price for a stock, also called a spread. Ally Bank, the company’s direct banking subsidiary, offers an array of deposit, personal lending and mortgage products and services. Here are the top books you can start learning from. Summing up all together, a well defined trading plan is a must for successful trading. The registered office of Exness B. Margin requirements are typically between 3% to 5% of the notional value. SMAs with short lengths react more quickly to price changes than those with longer timeframes. This involves checking the transaction details against the transaction history stored in the blockchain. In our article on trading computers, we go through this in greater detail. When paper trading with a demo account, you are not putting your hard earned capital on the line. Technical analysis is often complemented by fundamental analysis, which involves analyzing company spreadsheets, tracking growth curves, and monitoring revenue streams. Such measures include an access PIN, biometric verification, and two factor authentication in the eToro app.

Why Try Us

LalitToo many bugs: 1 Whenever I try to search for a share on the app using the magnifying glass icon on the top right corner, the app just shuts down. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Here’s what Financial planning is and why it is important. An evening star doji candlestick pattern is a bearish reversal pattern. While we can measure and evaluate these algorithms’ outcomes, understanding the exact processes undertaken to arrive at these outcomes has been a challenge. This approach helps ensure you can still be profitable overall, even if you have more losing trades than winning ones. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. Traders rely on these patterns to navigate the market’s inherent volatility, using formations like the head and shoulders to predict potential reversals. Ideal exit would be the day before fomc because that’s a pretty unpredictable event. Options traders may opt to not only hedge delta but also gamma in order to be delta gamma neutral, meaning that as the underlying price moves, the delta will remain close to zero. The only way to buy or sell them is via the intermediary of a broker or the investing business that manages the fund. The quotes above from Ed Seykota and Peter Lynch help hammer this point home. Salary is less than £50,270, and 20% tax if you earn over £50,270 per year. A financial advisor told me about TruWealth once but they had a minimum investment that I could not match. Basically, it requires an understanding of basics, market knowledge, emotional balance, and analytical and risk management skills. Robo advisor: ETRADE Core Portfolios IRA: ETRADE Traditional, Roth, Rollover, Beneficiary, SEP and SIMPLE IRAs, IRA for Minors and ETRADE Complete™ IRA Brokerage and trading: ETRADE Trading Other: ETRADE Coverdell ESA Education Savings Account, Custodial Account for minors and small business retirement plans. $0 commission for online U. Access to the highly regarded thinkorswim® platform. Direct Expenses: Direct expenses are the costs directly connected with the production of your products or services.

Investment options

In the above example, GBP is the base currency and USD is the quote currency. At first sight, Interactive Brokers is quite intimidating. This approach assumes that prices will continue to oscillate between these established levels until a breakout occurs. Navigating the stock market: How does it really work. We will not treat recipients as customers by virtue of their receiving this report. However, it’s worth noting a cliched dictum of the financial world: past performance is no guarantee of future results. Day trading means playing hot potato with stocks — buying and selling the same stock in a single trading day. This shift in mindset helped me view trading as a hobby, not as a quick way to get rich. When entering a long position, buy after the price moves down toward the trendline and then moves back higher. Updated: May 28, 2024, 4:04pm. Here’s a detailed look at how scalp trading works. Immerse yourself in a comprehensive, interactive experience with our expert led Stock Trading Masterclass Trading Training in Stockholm sessions. This is also known as the short term wholesale power market, especially in contrast to long term power trading on the power futures market. It’s a smooth experience to use the platform – as is placing a trade, which is possible from the charts. Bajaj Financial Securities Limited is only distributor of this product. When the trade is closed the trader realizes a profit or loss based on the original transaction price and the price at which the trade was closed. Like any skill, proficiency in investing increases with time and experience. Joseph Nacchio made $50 million by dumping his stock on the market while giving positive financial projections to shareholders as chief of Qwest Communications at a time when he knew of severe problems facing the company. What is the best indicator for scalping. “I’m always thinking about losing money as opposed to making money. Investors may hold assets for months, years, or even decades, aiming to benefit from the appreciation of the asset’s value or regular income through dividends or interest payments. Your shares are now worth $3,000. This not only enhances efficiency but also ensures timely responses to market fluctuations, giving traders a competitive edge. “What Is Technical Analysis. Depending on who you talk to, there are more than 75 patterns used by traders. To find the best app for stock trading, I compared trading apps from 17 brokers side by side.

Why Try Us

I have read it many times cover to cover as well. Invest in the world’s biggest companies for as low as ₹1. Create profiles to personalise content. Many of the traders interviewed said that patience played a big part – waiting for the right opportunity to come along. Does a pebble have the same impact on a pool of water as a boulder. Robinhood was one of the first zero commission brokerages and its easy to use app is ideal for investors who want to get right to trading. Nevertheless, its mobile app is quite intuitive and utilizes drag and drop options to place options trade far easier compared to other products. If the stock doesn’t fall below $50, or if indeed it rises, the most you’ll lose is the $2. As always, we recommend you do some testing in your demo platform first, primarily to get used to picking up signals much faster. This bullish set up would be activated on a daily close above $240; in this case, the trigger. At this time, Robinhood doesn’t offer paper trading. If you also like playing color prediction games, visit this website. TD Ameritrade’s thinkorswim platform offers a balance of user friendly features and advanced tools. By analyzing trading patterns on historical data, you will find out which patterns work the best with your strategy. 00 per lot, per side which is much better than the industry average of $3. One could become a Financial Advisor, guiding clients on how to manage their investments, save for the future, and optimize their financial portfolios for growth and security. 01 are regulatory fees applicable on sell orders only. Deposit $100 and get a $10 bonus. I’ve been scouring the Internet for information on tick charts and their ins and outs – but have found nothing useful. Net account, please register for a trial. But it’s not difficult to pick a portfolio as good as a robo advisor with a little experience and research.

Most Popular

The IG Trading app is particularly notable for its well designed layout, which features a plethora of advanced tools such as alerts, sentiment readings, and highly detailed charts. Statutory Charges/Taxes would be levied as applicable. About Weekend currency conversion. Pick the market you want to trade. Whatever technique a day trader uses, they’re usually looking to trade a stock that moves a lot. Fidelity offers Active Trader Pro, a trading platform that incorporates a number of its other tools and features. This involves buying and selling stocks within the same day. Who should practice intraday trading. There is no restriction on the withdrawal of the unutilised margin amount. A point to note is that a brokerage firm may impose a higher minimum maintenance requirement and limit pattern day trade to less than four times excess of maintenance margin. Deloitte reports that top global investment banks can improve their front office productivity by 27%–35% with generative AI. Unlike traditional time based charts, tick charts are based on the number of trades that occur. Investing takes a long term approach to the markets, while trading involves short term strategies to maximize returns daily, monthly, or quarterly. If there is no strategy while trading it can be extremely risky. For your position to be profitable, you’ll need the market price to either rise above the buy price or fall below the sell price – depending on whether you’ve gone long or short. Without getting too technical, there are companies that specialise in analyzing blockchains, and if a government wants they have a good chance of identifying who the people behind certain transactions are. Join For free Gift Code. A simple to use platform. EToro offers access to the largest crypto coin selection of any company we cover in the online broker space, and it does this with one of the most user friendly experiences in the industry. In case the ebook was not auto downloaded, click here. You can read the MCX circular here. Access to real time market data is essential in the fast paced world of futures trading. By staying on our website you agree to our use of cookies. Beginners will appreciate Coinbase’s user friendly interface and the simplicity of its buy and sell orders, akin to using an online brokerage platform for trading stocks. Here is the detailed share market holiday list 2024.

NSE NMFII

The trend is affirmed when the bullish trend gets through the neckline level and goes on upwards. Financial industry regulations permit an investor to borrow up to 50% of the purchase price of securities on margin, which is stipulated in the Federal Reserve Board’s Regulation T. The app offers a wide range of trading pairs, and the charting tools are top notch. Firstrade scored well for penny stock trading in our 2024 Annual Awards, and is a great choice for Chinese speaking investors. The balance sheet of an entity has a wealth of information that can be used to assess financial stability and performance. You need not undergo the same process again when you approach another intermediary. 74% margin interest rate, which drops to 9. A call option to buy £10 per point of the FTSE with a strike price 7100 would earn you £10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. Businesses can use this format to evaluate the effectiveness and impact of different pricing strategies on gross profit. The Three Outside Down candlestick pattern is formed by three candles. Not all account owners will qualify. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. 2018 today: Investor, writer, analyst. Sarjapur Main Road, Bellandur. Day trading is not the path to quick or easy profits. A balance sheet is the last drawn financial statement which reports a company’s assets, liabilities, and the shareholders’ equity at a particular year in time, and provides a basis for computing the rates of return and evaluating the capital structure of the company. Having been a retail trader since 2013, Plamen has gained an in depth understanding of the challenges that novice traders face today. If you import machines or equipment, you have to renew the license every two years. Speed, quality, transparency.

Alex Macris

Normal trading hours on the New York Stock Exchange and the Nasdaq are 9:30 a. This makes a company’s directors and high level executives insiders. What is Intraday Trading. Best for Copy Trading. Regardless of the products or markets being traded, risk is important to understand https://pocketoptiono.website/ for all day trading beginners. Find out more about Fibonacci retracement levels and how you can utilise them in your trading. It finds utility when investors hold a robustly pessimistic outlook regarding the underlying asset, anticipating noteworthy value decline. 11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. A skilled intraday trader studies the chart to forecast future market patterns and does not rely on tips excessively. This is exactly how I always envisaged automated trading to be. Because CFDs are leveraged, you can open a position by outlaying an initial amount that’s only a fraction of your total exposure to the market. 153/154, 4th Cross, Dollars Colony, Opp. Dojis frequently occur after strong trend moves and/or at previous support/resistance levels. These are his eight investing lessons. He has more than a decade’s experience working with media and publishing companies to help them build expert led content and establish editorial teams. Measure advertising performance. Although if you’re using it on mobile and click on someone’s profile you can’t go back as there isn’t a go back button so you lose where you were or which comment you were reading and have to start from top of the news page etc. Exchanges have requirements that companies must meet in order to become listed. Order execution occurs in real time. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. Read our full review of IG Group. Best In Class for Offering of Investments. For example, are you looking to focus on an app that offers industry leading fees, or are you more concerned about trading a specific pair. Forex scalping is a trading style that’s used by forex traders. Please see our General Disclaimers for more information. Record and review your trades with the TraderSync App from your mobile phone. An indicator that helps determine whether the market is being oversold or overbought based on the current price compared to a range of prices over time.

Education

However, it comes with severe risks and requires a significant understanding of the markets. The industry’s best pricing. Whether you’re just starting or looking to expand your knowledge, it supports your learning journey, helping you hopefully to navigate the complex world of investments. While these forms of education are crucial, they cannot prepare you for every situation you will face when day trading. Once you have a live account with OANDA, you can download the OANDA mobile app. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Margin trading with 10X leverage. A paper trade is a simulated trade that allows an investor to practice buying and selling without risking real money. For example, say you buy a put option for 100 shares of ABC stock at $50 per share with a premium of $1 per share. This is an excellent low cost option for retail investors who are likely to make more than three trades per quarter. On Mirae Asset’s secure website. Also, because the spot cash forex markets are so large and liquid, the ability to enter and exit a trade at the desired level is much easier than in other less liquid markets. Generally lower brokerage fees and transaction costs. Anyone worldwide can use it easily. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. If a stock experiences a downward trend, that trend may run out, and that could result in the stock entering an upward trend, which may be a good time to buy. Traders can virtually eliminate any risk associated with trade by combining options. Static charts or interactive TradingView charts: Your pick. Equity Delivery Brokerage. Traders aim to take advantage of short term pricing fluctuations in the market. Based customers holdings to the IRS. So, if you borrow Rs 400, the daily interest would be Rs 0. Of the five mobile apps that Fidelity offers its customers, it’s the newly designed Fidelity Investments app that opens the door for all types of investors and traders to access key full service features like a top tier investment offering, a large selection of available account types, available brick and mortar support centers, and so much more. Public looks nice from a ux/ui standpoint and has ETFs and now Treasuries.